We are used to thinking about COVID-19 as a health disaster. However, it is also an economic one.

COVID suffocates the body by preventing air from entering the lungs. In a COVID economy, we have flooded the system with money and suffocated the nation with debt. The decrees of the Federal Reserve work like a ventilator that keeps the economy artificially alive. However, a day of reckoning will come since the system cannot remain forever on life support without sustaining grave damage.

The pre-COVID economy was already in bad shape. The pandemic provided the pretext to take already defective measures and expand them exponentially. We now face a disaster of massive proportions as debt increases, credit markets freeze, and inflation threatens.

A Flood of Debt

The cause of suffocation is debt in all its forms. The lockdown of the nation did irreparable damage to the economy by unleashing a flood of more debt.

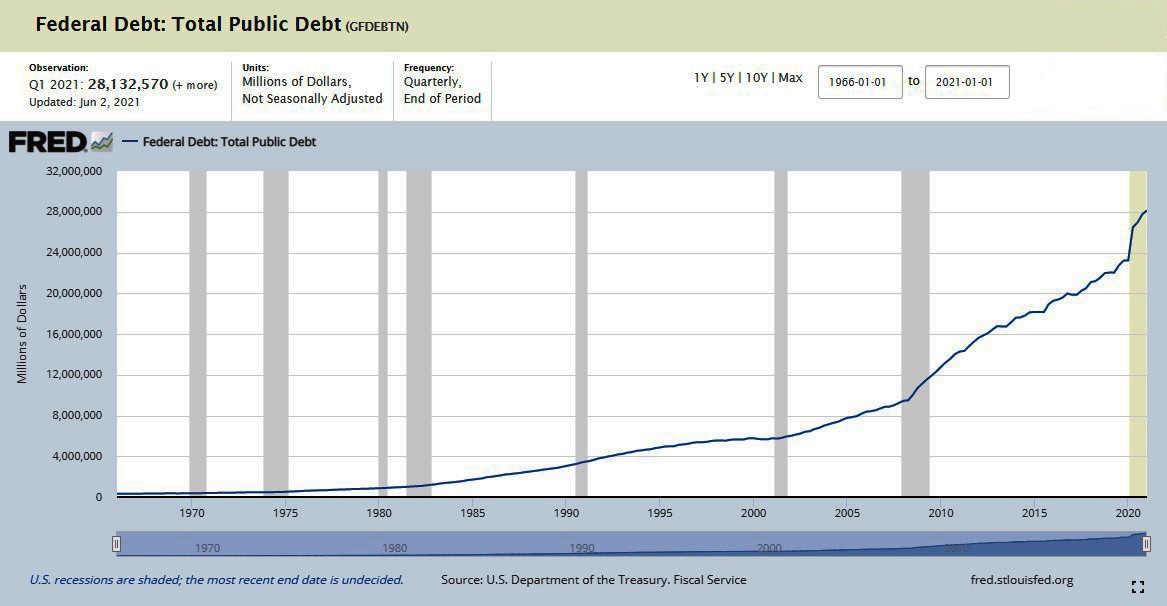

There was free “helicopter” money in the form of stimulus checks that injected vast amounts of money into the economy despite questionable proof of their efficacy. The proposed infrastructure bills call for spending trillions of dollars to jumpstart the economy after the COVID shock. All these things contribute to or increase the more than $28 trillion of federal debt on the books.

Making the Case for America’s Return to Order

In addition, corporate America has gorged on debt during the lockdown period. Its tab now stands at over $11 trillion, or half the size of the American economy.

Government aid programs and low interest rates are driving debt levels into the dangerous zones that would overwhelm a normal economy. The debt machine depends on the Federal Reserve ventilator to keep lending cheap and plentiful.

Turning on the Ventilator

The debt dilemma is: “How long will the ventilator stay on?” The Federal Reserve is keeping long-term interest rates at historically low levels to keep money flowing artificially.

After the 2008 financial crisis, the Fed initiated a policy called quantitative easing (QE). This allowed the Central Bank to buy trillions of dollars worth of Treasury bonds, mortgage-backed securities and other types of long-term credit instruments. Such credit purchases have the effect of keeping long-term interest rates low. In January 2015, when the Fed started to wind down the program, there was already a staggering $4.5 trillion of assets on the books.

The COVID crisis served as a pretext to restart the quantitative easing spending spree. In March 2020, the Fed threw caution to the wind and entered into another round of asset-buying. This time, it is sweeping up even corporate debt from the market. Economists estimate that the cash value of the Fed’s assets could reach $9 trillion by the end of the year.

The Forgotten Infrastructure Projects of 2021

The result has been a flood of low-interest rates that trickle down to saturate all credit markets. A record amount of money is snapping up an ever-diminishing pool of safe investment opportunities taking yields on investments to all-time lows. The trusty Treasury bond now generates 1.16 percent interest on a seven-year note. Bank interest on saving accounts is almost nothing.

This easy money credit ripples through all markets with a chain reaction effect. With traditional investment opportunities proving scarce, investors are using cheap money to gamble on ever riskier ventures, like junk bonds. However, the Fed is even snapping up junk bonds with their higher yields so that even these bonds, after an initial spike, are now at record low returns.

Indeed, the economy is overheating as investors turn to the already supercharged stock market, meme stocks, cryptocurrencies, non-fungible tokens, real estate and any other strange investment products that might yield a decent return.

There is so much money in the system that banks are asking corporations not to park funds with them. Bankers complain that the traditional credit market is so distorted by cheap corporate bonds that companies are not coming to banks. Thus, financial institutions cannot turn their deposits into income-generating loans.

No Vaccine for a COVID Economy

We are in a COVID economy. As long as the Fed keeps interest rates artificially low and the money supply abnormally high, there will be no relief. The ventilator must be turned off.

Learn All About the Prophecies of Our Lady of Good Success About Our Times

Learn All About the Prophecies of Our Lady of Good Success About Our Times

And yet, can the money doctors at the Fed remove a ventilator? Do they even know how? They have kept the nation addicted to ultra-low interest rates for so long that the patient may not survive the shock of disconnection.

A vaccine for the COVID economy could only consist of taking away the suffocating credit and adopting sound economic policies that involve the practice of virtue and not the frenetic intemperance of our overheated markets. So far, nothing like this moral conversion is happening. On the contrary, the ventilator is feeding the thirst for ever riskier missteps.

Photo Credit: © Skórzewiak – stock.adobe.com